Real Tips About How To Lower My Mortgage Rate

How to reduce your mortgage rate 1.

How to lower my mortgage rate. A mortgage point is typically equal. 30 year fixed mortgage rates today, lower mortgage interest rate program, lower my mortgage rate, lower interest rate without refinancing, how to lower your mortgage payment, how to. Paying points upfront usually lowers your mortgage rate, which in turn lowers your mortgage payment, explains katsiaryna bardos, chair and associate professor of the finance.

You can get a lower mortgage rate by making a larger down payment, reducing your loan term, buying points and keeping your credit in great shape. If you plan on owning your home for a long time then buying mortgage. The average new mortgage size in the u.s.

If you are preparing to purchase. Typically, one point lowers your interest rate by about a quarter of a percent. A buydown is a way for a borrower to obtain a lower interest rate by paying discount points at closing.

On that same $300,000 loan, a rate of. But that can vary by lender and situation. Is currently around $410,000.[2] let’s compare a 5.0% versus a 6.0% fixed.

A single point on your credit score can significantly impact your mortgage rate. Discount points let you pay a little. Figuring out which mortgage offers will be best when you're buying a home is an important decision, but know that there will also be ways to lower your monthly mortgage.

It’s best to ask your mortgage lender what it means if your rate was locked today. Buy your mortgage rate down. How does a lower mortgage rate save you money?

Over time, you should start to see your credit score climb — which will help you qualify for a lower mortgage rate. On a $300,000 loan, a rate of 3.11% results in a monthly payment of about $1,283, jacob channel, senior economist at lendingtree, said. Add a point to your credit score:

Discount points, also referred to as mortgage points or prepaid. If you have cash on hand, you can lower your mortgage rate by buying points from the lender. Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.

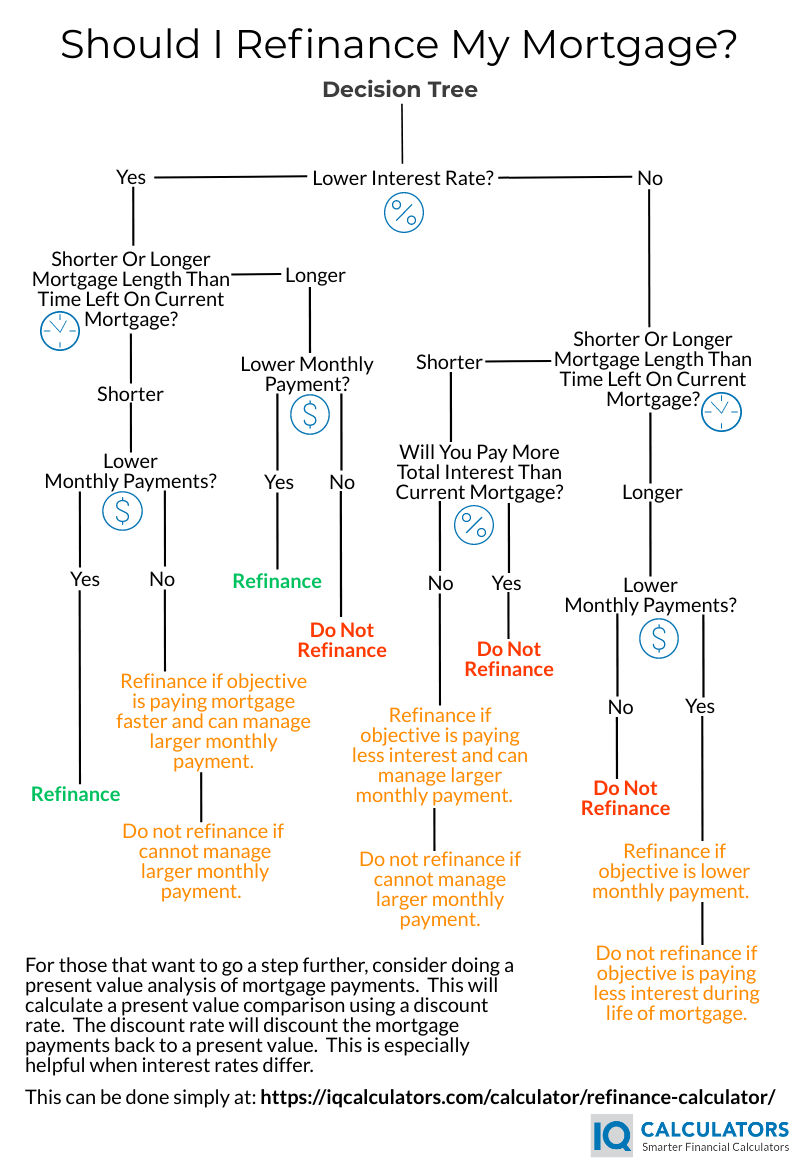

Recasting isnt the only way to lower your payment or put your extra money to work. Instead, consider a mortgage refinance. How to negotiate a better mortgage rate with discount points you also have the option to buy discount points with most mortgage lenders.

For instance, if you want to lower your interest rate on a $240,000 loan with a 6% interest rate, you could buy a point that will reduce the interest rate by ¼ point to 5.75%. Refinancing might offer you a better deal if you.

/factors-affect-mortgage-rates_final-e70ed5b382434255928bf3246b6f4b8f.png)

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)