Lessons I Learned From Tips About How To Buy Ginnie Mae Bonds

These securities are technically bonds, and are sometimes simply called gnmas.

How to buy ginnie mae bonds. If you are not looking. Government national mortgage association (ginnie mae) contact: Ginnie mae) and guaranteed by the federal government.

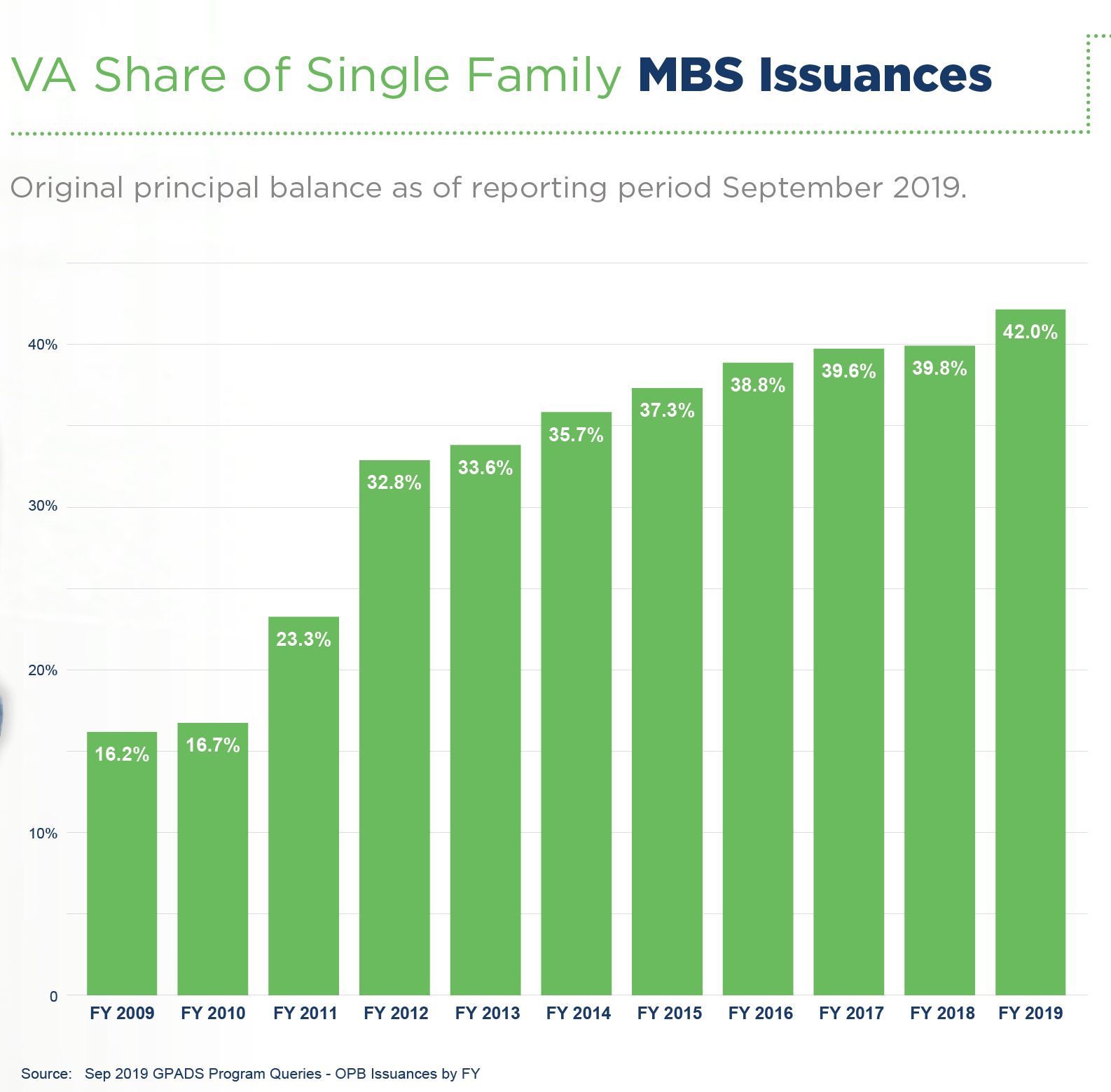

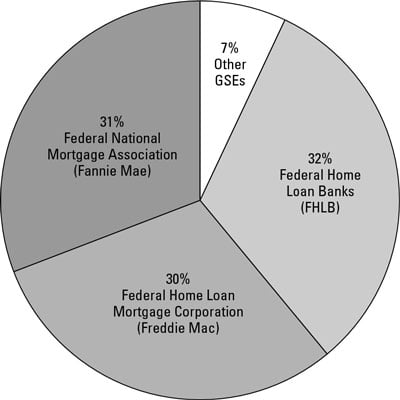

Ginnie mae is one of three major bond issuers that allows for the funding for most consumers in the real estate market. Gnma (ginnie mae) bonds carry the full faith and credit guaranty of the u.s. The full faith and credit guarantee of the u.s.

Following this, you can purchase additional securities for as little as $1. Lenders create a pool of loans. The government national mortgage association (gnma or ginnie mae) issues agency bonds backed by the full faith and credit of the u.s.

A key difference between fannie mae versus freddie. Low cost exposure to u.s. With more market liquidity and guarantees, lenders can more freely issue.

You can buy shares in a ginnie mae mutual fund directly. Funds in this category generally have at least 90 percent of their holdings in u.s. The vanguard gnma fund falls within morningstar’s intermediate government category.

If you don't have $25,000 sitting around to invest directly in ginnie mae issues, you can invest through a mutual fund for a lot less.